Empty cart

Oh no! It appears your cart is empty. Add some almonds to your daily regime with the Treehouse products.

All Blog PostsAlmond Market UpdatesNews

Shipments of almonds from California totaled 161.1 million lbs in March, down 15.3% from shipments of 190.1 million lbs in March a year ago. Last year’s March number reflected pent-up shipments following a port strike and a lower number was anticipated. Domestic shipments, which are more easily compared, were down 25.8% at 41.7 million lbs and reemphasize the damage in almond consumption caused by earlier high prices. Domestic shipments are now down 8.9% season to date, while export shipments are off 7.0%.

Commitments are reported at 423.2 million lbs, up slightly from a month ago (419.2 million lbs) as handlers added 165.1 million lbs of 2015 crop new sales. This is the best monthly sales since October and reflects brisk interest at what are now being perceived as attractive price levels. Total committed plus shipped to date calculates at 71% of total supply coming into the season. This lags a little behind where the industry usually sits at this juncture and suggests that there is still selling to be done.

On the supply side the current crop is in the barn at 1886 billion lbs. Conditions for new crop have been favorable. While not a drought buster, an El Nino winter brought above average rains and snowpack to northern California while the southern valley was a little less favored. Bloom conditions were terrific, with February being largely warm and dry and trees waking up strongly after good dormancy. Consequently, expectations have been set for a good crop with the usual wide range of early numbers being circulated- we have heard between 1950 and 2250 million. This morning Michael Grant and Liam Gorman cast their long shadows over the industry, releasing their annual forecast at a well-reasoned 2060 million lbs. They hit it dead on last year and their prognosis is widely watched. Like it or not, it will be the number the industry will use over the next month or two. We have no compelling disagreement. Our crop in the south looks better than last year but we were down 20% on some varieties in 2015. Central and north general fared better in 2015 and are unlikely to be strongly up versus last year. Interestingly, Michael and Liam factor in net new bearing acreage at only 20,000 acres, pointing to about 35,000 acres of tree removals as growers deal with expensive water and anticipate lower almond prices.

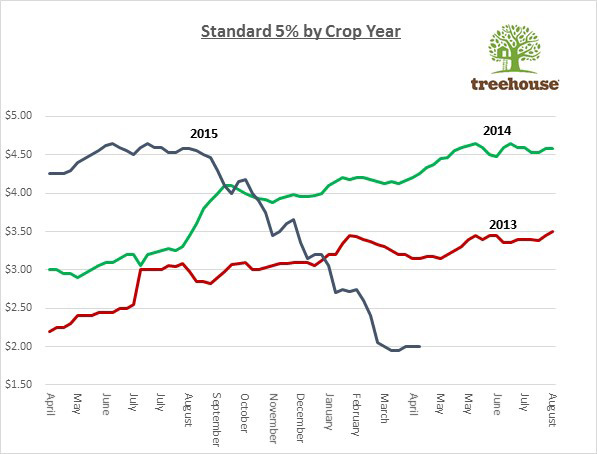

Almond prices over the past month held steady, with standards hardly straying from the $2.00 per lb level. Premiums for sized Californias have been skinny as handlers run low on smaller kernels. Nonpareils have ranged between $2.40 to $2.75 per lb. Gaps in the nonpareil offerings are starting to appear with 27/30’s and smaller becoming scarcer and 20/22’s also hard to find. Inshell demand has picked up again with pricing seen between $1.80 to $1.85 per lb. Manufactured almonds traded consistently between $2.80 to $2.90 per lb for sliced and sliver.

We anticipate the market to relatively unmoved as it weighs the new information. Domestic shipments are a disappointment. However, it was anticipated that exports would rebound more quickly than domestic. Furthermore, the strong commitment and brisk March sales numbers presage decent shipments over the summer. We continue to feel that carry-over has a very good chance of being significantly under 500 million lbs. The Michael/Liam crop forecast will elicit a sigh of relief from sellers, some of whom still have work to do on current crop. With almond prices now at attractive levels both historically and versus competitive nuts downside risk is being seen as low by buyers worldwide and confidence is creeping back. Removing the risk of a disruptive crop forecast will further encourage buyers. However, with more selling still to be done and with strong shipments still an anticipation rather than a reality quite yet we expect prices to remain near current levels for the time being.

For perspective we are adding a chart this time around. Better than a thousand words…

Best Regards,

Jonathan Meyer

CEO Treehouse California Almonds, LLC.

Stay tuned for the release of significant almond industry information, such as almond crop estimates and acreage reports. You’ll also find Almond Board shipping reports and related analysis from the Treehouse Almonds Leadership Team.

Be in the loop for vital news about the California almond market.

Enjoy 10% off when you order 6 or more