Empty cart

Oh no! It appears your cart is empty. Add some almonds to your daily regime with the Treehouse products.

All Blog PostsNews

California handlers shipped 263.2 million lbs in November, up 11.6% compared to shipments of 235.9 million lbs in November a year ago. In a season where monthly shipment increases in the 25% to 35% range have become the norm, the number at first glance looks unremarkable but is nevertheless a new November record and a strong performance during a very challenging period of vessel and booking constraints.

Both domestic and exports shipments posted similar gains (around 11.6%). Exports shipments were bolstered by very strong November Chinese shipments (up 108% to 34.6 million lbs), while Indian shipments (up 15.5% at 33.4 million lbs) pulled back to more realistic levels after unsustainably strong shipments in September and October. Shipments to Western Europe (up 10.9% at 59.2 million lbs) continue on pace. Middle East shipments (down 30.7% at 20.7 million lbs) and Japan (down 30.1% at 6.7 million lbs) added drag.

Seasonal shipments to date (Aug through Nov) stand at 1026 million lbs, up 21.5% from the first four months of the 2019 season. With premiums for spot business common, we can be relatively sure that these shipments are going straight into consumption channels and is a good reflection of consumption strength.

Commitments continue well ahead of last year’s levels, with end November commitments at 1005 million lbs a full 55% higher commitments of 649 million lbs a year ago. Inferred from this number would be strong new November sales of 235 million lbs, compared to 191 million lbs in November last year.

End November receipts of 2,414 million lbs give us a tantalizing glimpse at the final crop tally, but still not enough to be fully confident. Receipts are 331 million lbs, or 15.9% ahead of last year’s 2,082 million lbs. The crop is forecast at 3000 million lbs, 450 million lbs, or 17.6% more than a year ago. So how much is left to go? Is there still 586 million lbs to come through the hullers. November receipts of 603 million lbs, show a slow-down from October (758 million lbs), but hullers still operating at higher capacity than November a year ago when 492 million lbs were reported. In our area several hullers were finishing up just after Thanksgiving, while most are expected to finish before Christmas. Even if you assume that the pace of receipt increase (15.9%) continues through the end of the season, we only get to a crop number of 2,960 million lbs. At this juncture we will conservatively stick with the 3000 million lb forecast and would comment that calls for a significantly larger crop than 3000 million lbs carry less weight than prior to this report.

After the October position report a month ago we commented that it appeared that the market was ready to put a bottom in place. Prices over the past few weeks have reinforced this view. Standards, which were at $1.75 a month ago, now are bid at $1.88 with much of the move occurring in the past 2 weeks. Nonpareil prices have likewise firmed, with easily available NPX 27/30 most recently bid near $2.05 per lb. Good interest from Indian inshell buyers spurred Nonpareil inshell about 5 cents per lb, with levels most recently seen near $1.58 per lb.

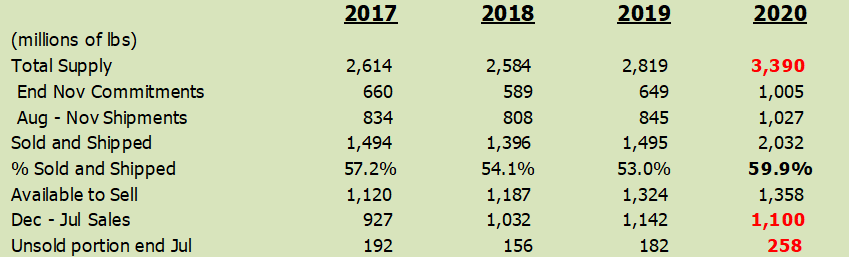

Up to this point in the season we have seen selling pressure keep a lid on price increases. Sales to date have been massive, and now we try to anticipate what the balance of the season might hold. A few numbers comparing recent years might be useful:

Figures in red are not yet actual. Figures in black are actual.

The total supply assumes the crop at 3000 million lbs (less 2% loss), added to the carry-in of 450 million lbs. The sold and shipped percentage of 59.9% is a very comfortable position for California.

The unsold portion of the total supply is now about level with availability a year ago. Sales for the balance of the season (December through Jul) last year totaled 1,142 million lbs in a falling market, not usually confidence inspiring. While there is a propensity for California sellers to sell what they have, it might be reasonable to assume that the end of July unsold position might be slightly higher, particularly if there is any uncertainty regarding the 2021 crop. With all these assumptions (yes there are many) there is a good argument that sales pressure for the balance of the season will about the same, or a little less than last year.

Today’s report should keep the market firm. On the demand side the Chinese number is encouraging, the Indian number will be good for the local market, the overall shipment number is decent in light of port challenges and December shipments will likely benefit from some of the rolled bookings. Sales were relatively strong, helped by a weak dollar, but also by increasing confidence that prices are unlikely to head lower. On the supply side, the crop increasingly looks likely to land near 3000 million lbs, with most of it already sold and shipped.

Stay tuned for the release of significant almond industry information, such as almond crop estimates and acreage reports. You’ll also find Almond Board shipping reports and related analysis from the Treehouse Almonds Leadership Team.

Be in the loop for vital news about the California almond market.

Enjoy 10% off when you order 6 or more