Empty cart

Oh no! It appears your cart is empty. Add some almonds to your daily regime with the Treehouse products.

All Blog PostsNews

The first position report of the 2024 crop season published unsurprisingly slow shipments of 168.3 million lbs in August. This is 7.1% lower than last year’s mark of 212.0 million lbs. While domestic shipments were essentially flat (+1%) at 62.1 million lbs, export shipments fell significantly short of last year (-20% or 43.7 million lbs) with just 168.3 million lbs in August.

Several major export destinations contributed to the lackluster export shipments in August. Headlining these weaker numbers were Europe (down 40% or 25.9 million lbs) and the Middle East (down 41% or 7.2 million lbs). Shipments to the UAE were decidedly down 59% to just 4.6 million lbs in August. It should be remembered that, at this time last year, sellers were under pressure to move what had become the largest carryout on record of 800 million lbs from the 2022 crop. When contrasting with this year’s carryout, California handlers had just 502.7 million lbs carryout of the 2023 crop, with only ~265 million lbs unsold. Thus, the remarkable decline of shipments in these markets can be largely attributed to the reduced inventories that were available to ship.

Shipments to India remained robust as late sales of the remaining 2023 crop inshell booked at prices below today’s levels continued to supply local markets. With nearly 28 million lbs of shipments in August (+24%), India appears well supplied through the earlier than usual Diwali season. While nonpareil inshell premiums remain relatively flat against kernels today, the need for inshell to be booked post-Diwali could be pointing to upcoming momentum for prices in the coming weeks.

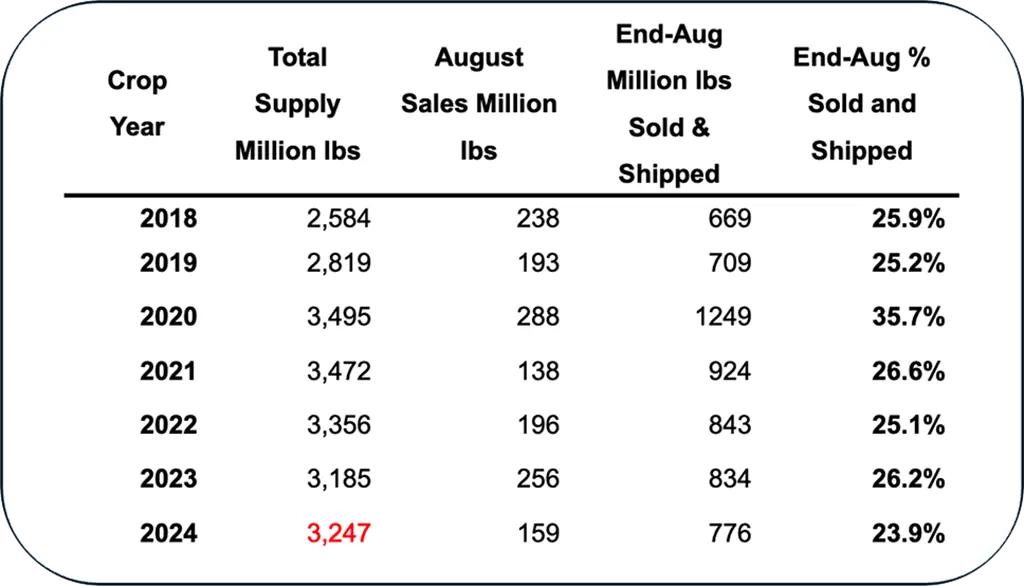

Commitments by California handlers stood at 607.6 million lbs, a decrease of 2.3% from last year’s mark of 621.9 million lbs. When calculating sales for August, it is important to remember that old crop commitments (237.5 million lbs in July) are rolled into new crop commitments. Therefore, the calculated August sales number of 159.4 million lbs is now a combination of old and new crop sales as these become inseparable. New sales of 159.4 million lbs in August are remarkably lower than years past. When comparing industry sold positions, the proper figure to employ is sales as a percentage of total supply, which accounts for heavy carry-in years that reflect a higher than usual unsold portion. Below demonstrates the end-August sold position for the industry compared to past years. Note that the 2024 total supply assumes a 2.8 billion lb gross crop and that figures in red resemble forecasted numbers.

The key takeaway is that the end-August industry sold position is the lowest seen in recent years. While export sales of 150.2 million lbs are down 25.7% from last year, domestic sales of just 9.1 million lbs were down 83% from last year’s sales of 53.7 million lbs.

Receipts of the 2024 crop are noticeably higher than last year solely due to the delayed start to the 2023 harvest and hulling season. When removing last year’s outlier of 70.1 million lbs of receipts, it is noted that 290.1 million lbs of August receipts in 2024 are more in line with historical averages of around 250 million lbs. Nonpareil, the first variety to be harvested, has received early reports of yields between 10% and 20% lower than last year. The NASS Objective Estimate projected a 17% increase in nonpareil production up to 1.1 billion lbs from last year’s deliveries of 941 million lbs. Today’s sentiments of lower yields, dryer kernel weights, and higher than expected inedibles (2.54%) may cast doubt on the NASS prediction of nonpareil production in the 2024 crop.

After the July shipment report, prices stayed relatively flat. Within just a few days, news of lower-than-expected yields from the field resumed market firmness as standards have moved from $2.05 per lb to $2.25 per lb in the last 30 days. Nonpareil offerings slowed as handlers reassessed forecasted inventories available to sell, and prices reacted, with Nonpareil Extra #1 27/30 moving from $2.60/lb up to $2.80/lb today. A relatively quiet NPIS market is near $1.90/lb ($2.71 kernel equivalent) and is struggling to keep up with kernel premiums today.

So, where does the market go from here? Buyers may interpret the slow start to the season as a glaring need for California to ramp up sales. As the crop continues its arrival, cash concerns and limitations in warehousing may serve as external motivators for sellers to soften prices to move inventory. The disparity of prices today compared to last year will not help the appetite of buyers who may feel a sense of sticker shock as standards are currently at a three-year high.

Conversely, sellers may recognize that slower shipments and sales may signal an upcoming need for buyers to cover demand through the end of the calendar year and into Q1 2025. Questions around the validity of the assumed 2.8 billion lb crop along with the tighter transition from old crop to new crop may suggest that supply is increasingly in balance with demand at today’s prices. Recent developments of a weakening dollar in August additionally provide some relief to buyers in the face of a firming market.

Ultimately, the future of the market relies upon the crop. While some out of the north are seeing higher yields at the early stages of harvest, central and southern valley declines in yield per acre have some in the industry lowering crop expectations to 2.65–2.8 billion lbs. The smaller 2023 carryout only amplifies the effect of a shortened 2024 crop number, as higher prices may be justified if shipments are constrained by lack of supply.

Be in the loop for vital news about the California almond market.

Enjoy 10% off when you order 6 or more